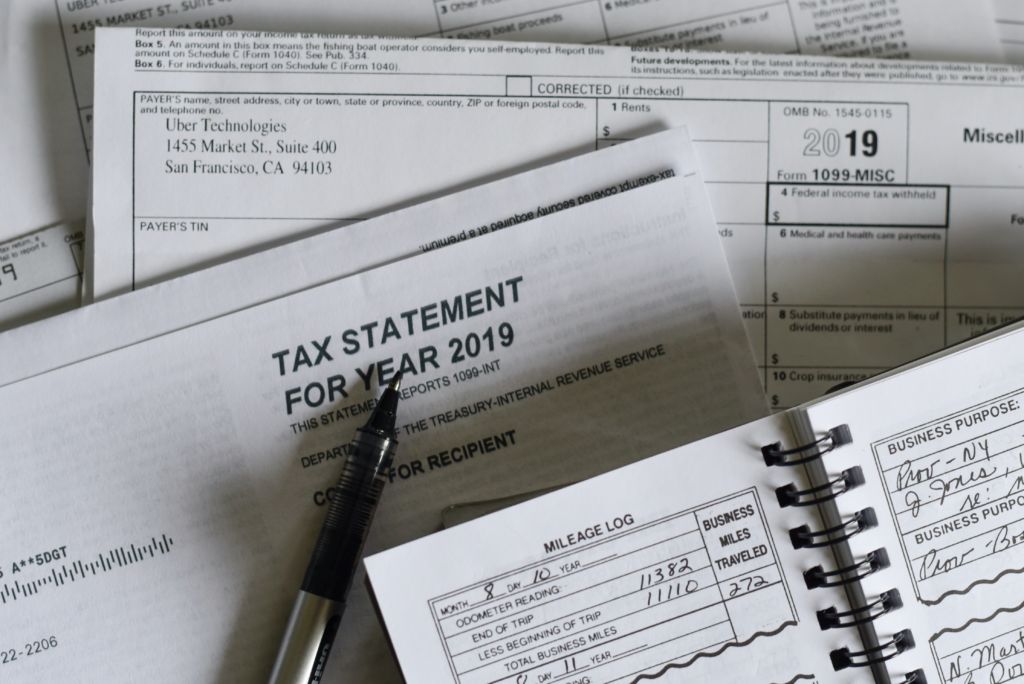

What Does the Ohio Individual Income Tax CP2000 Unreported Income Notice Mean For You?

Updated January 2022: This particular CP2000 Notice is specific to tax years 2015 thru 2019 and focuses on taxpayers who have understated their income on

Updated January 2022: This particular CP2000 Notice is specific to tax years 2015 thru 2019 and focuses on taxpayers who have understated their income on

If you’re in trouble with the IRS, the first step is to get a good tax lawyer. Tax lawyers can help with a wide variety

An IRS tax audit is no small matter. In the 2019 Fiscal Year, the IRS audited over 771,000 tax returns, which resulted in nearly $6.7

There are few things that instill more fear in Americans than an IRS Tax audit. Fortunately, audits aren’t as bad as they’re made out to

Filing for bankruptcy is an extremely challenging process. You need to determine which type of bankruptcy to file for, gather and file documents, and argue

The COVID-19 outbreak is affecting every aspect of daily life, from children going to school remotely, to enforceable social distancing rules. The influence of this

There are three certainties in life – Death, Taxes, and being confused by taxes. If you’re dealing with convoluted tax codes, deductions and proper filings,

Small business owners know that come tax season, every deduction counts. But few know just how much they can save with the right deductions. Writing

Working from home has become more and more commonplace in business. With video chatting, screen sharing and call in conference lines, many office jobs are

While filing for bankruptcy in Ohio is never ideal, it’s often a misunderstood and dreaded option when trying to deal with debt. But bankruptcy doesn’t

Having outstanding debt can be an enormous weight, which only grows heavier the longer it goes unresolved. If your debt goes unchecked for too long,

Filing for Bankruptcy in Columbus and throughout Ohio is an incredibly complicated process, every step of the way. From dealing with loans and creditors, to